One of the "secret" scalping trading technique for stocks, commodities, futures and forex markets professional traders use.

Forex scalping means the quick opening and closing of trading positions generally within a timeframe of about 3-5 minutes at most, sometimes with trading time as little as one minute. This way forex trader can make many trades with potential profit of just few pips.

Forex scalping became popular because many traders consider it as a safe trading style. Due to very short period of trading time, market exposure of a scalper's positions is much shorter than of a swing or day trader as well as of a big trend follower. Using this trading style forex trader avoids the risk of strong market moves and large losses resulting from them. Whatever scalping strategy

you choose - brief periods of volatility is what only matters. Successful scalping methods are based on

the sharp movements which frequently occur in the currency market when temporary shortages of liquidity create imbalances that offer trade opportunities.

One of the most popular forex scalping strategies uses the trading system called Camarilla which was created in 1989 by Nick Stott - a successful trader on bonds and other financial markets. After a short time Camarilla method

became very popular among professionals trading S&P futures and Forex.

What is Camarilla indicator

Camarilla Indicator creates special technical levels and gives forex trader profitable opportunities in intra day trading both with and against the trend.

Camarilla Levels are calculated using the following formulas:

H4 = [1.1*(H-L)/2]+C

H3 = [1.1*(H-L)/4]+C

H2 = [1.1*(H-L)/6]+C

H1 = [1.1*(H-L)/12]+C

L1 = C-[1.1*(H-L)/12]

L2 = C-[1.1*(H-L)/6]

L3 = C-[1.1*(H-L)/4]

L4 = C-[1.1*(H-L)/2]

Where:

H = previous day’s high

L = previous day’s low

C = previous day’s Close

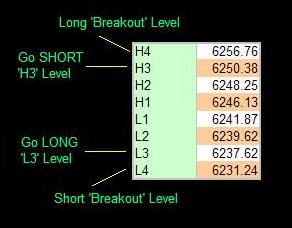

This calculation gives you 8 levels of intraday support and resistance levels. There are 4 of these levels above yesterday's close, and 4 below.

Three traditional ways to use Camarilla:

1. If Market opens INSIDE the L3/H3 levels, you must wait for price to approach any of these two levels. If the higher H3 is hit, go short against the intraday trend in the expectation that the market is going to reverse. Protective stop-loss is above H4. If the Lower L3 level is hit first - go long against the trend. Protective stop is below L4.

2. Market Opens OUTSIDE L3/H3. In this case, you wait for the market to retreat back through the L3/H3 level. Then you sell below H3 or buy above L3 using L4/H4 levels act as you stop loss. In this case you will be trading with the intraday trend.

3. Look at L4/H4 levels to be breached, which would signal of an initiation of the sharp directional intraday market move. It means that you are going LONG if price penetrates UP through the higher H4 level, or going SHORT if price penetrates DOWN through the lower L4 level.

Some researchers of this method of trading claim that the reversals from L3 and H3 happen as often as 4 times out of 5 within trading day.

Many traders consider useful to combine Camarilla with the Pivot Levels. Such combination is supposed to reveal more reliable intra day structure of price levels suitable for aggressive intraday scalpers.

Traders using Metatrader Platform can find very useful the indicator SDX-TzPivots created by Shimodax. It contains Camarilla, Pivot Points, Fibonacci levels and some other interesting features for automated calculation and drawing levels. Download SDX-TzPivots Indicator and read how to set Camarilla up.

|